Electric Bicycle Market Insights From Industry Experts

By: The Nerd Collective

Leaders from Workstand, Circana, and Bicycle Market Research answer questions about the electric bicycle market.

The Nerd Collective is a collaboration between Ryan Atkinson, president and co-owner of Workstand; Matt Tucker, director of client development at Circana; Peter Woolery, managing member of Bicycle Market Research; and Liam Donoghue, bicycle industry senior research manager at PeopleForBikes, who meet each month to develop data-backed insights on the bike industry’s most pressing issues.

Electric bicycles (e-bikes) are the number one growth driver for the bike industry over the past five years. According to Circana, e-bikes were responsible for 63% of the growth in dollar sales of all bicycles between 2019 and 2023, contributing 20% of dollar sales and 4% of unit sales across the entire measured market in 2023.* E-bikes are also the fastest growing bike category in independent bicycle dealer (IBD) e-commerce.** In this installment of our Nerd Collective blog series, our industry experts fielded several questions about the e-bike category.

ACCESS PEOPLEFORBIKES MEMBER-ONLY DATA INSIGHTS IN THE BUSINESS INTELLIGENCE HUB

Not a PeopleForBikes member? Join the Coalition today.

Is E-Bike Growth Slowing in the U.S.?

At the start of 2024, there was some concern that the e-bike growth curve was starting to slow. However, now that we have access to Q2 2024 data, the dip in 2023 is starting to look like an anomaly due to sales being pulled forward in 2022. According to Circana, e-bike unit sales increased year to date through April 2024 with a 13% growth compared to the first four months of 2023.*

Workstand IBD e-commerce sales patterns also suggest that consumers still have a strong appetite for purchasing e-bikes. Year-over-year online unit sales growth for e-bikes in April/May 2024 is strong at 60% relative to 2023, albeit slightly lower than the 69% growth rate seen during the same period between 2022 and 2023.**

This growth isn’t limited to sales of e-bikes — interest in and usage of e-bikes looks to be increasing as well. A study from the Physical Activity Council found that in 2023, 19.4% of Americans who rode a bike at least once reported using an e-bike, up from 7.8% in 2021. This report is available for free to PeopleForBikes members in the Member Center and for purchase on PeopleForBikes’ Resource Marketplace.

Are the Average Selling Prices of E-Bikes Coming Down?

According to Circana, the average selling price (ASP) of an e-bike through the specialty channel (IBDs) is $3,055, compared to $669 for rest of market (ROM) channels (e.g., big box, sporting goods stores, etc.)* Further, unit sales are growing at a faster rate in ROM channels than IBD channels, suggesting that casual e-bike ridership is growing faster than enthusiast demand. Though the ASP is stable or declining in both segments (ASPs declined 5% in 2023 vs. 2022 at IBDs and were flat at ROM*) the impending tariff increases on imports from China could push ASPs back up.

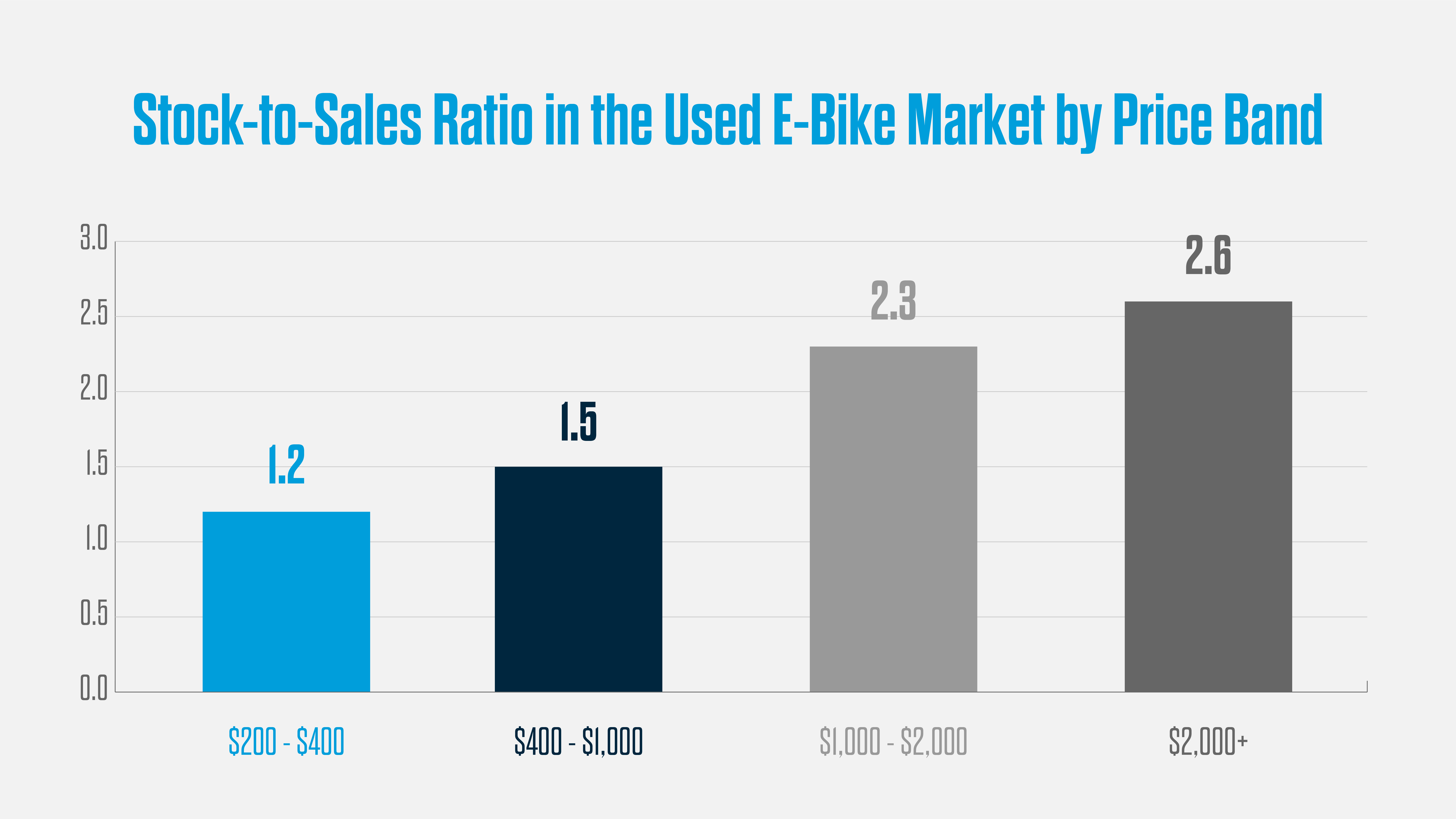

In used bikes, demand for low price points appears to be strong, while mid and high price points aren’t as impressive. As depicted below, the lowest stock-to-sale ratio in 2024 through May was in e-bikes between $200 and $400, where the ratio was slightly above 1.0. This means that demand was strong enough in these price bands to nearly exceed new used bike listings. Above $400, the stock-to-sale ratio gradually increases from 1.2 up to 2.3 at the $1,000-$2,000 price range. Above this price, the stock to sale ratio stabilizes at ~2.6. This trend suggests that the high availability and discounting of retail and direct-to-consumer e-bikes are depressing demand for similar bikes in the used market. Sellers willing to lower their prices into the range typical of mass market e-bikes are seeing a greater match with ready buyers.***

You can access up-to-date used bicycle sales data in the PeopleForBikes Business Intelligence Hub.

How Willing Are Customers to Buy E-Bikes Online?

According to Workstand, e-commerce sales growth of e-bikes is outpacing the overall IBD channel.** Though only about 2% of e-bikes sold by bike shops in Q1 2024 were sold online, the annual growth rate of 45% indicates a possible channel preference shift for consumers. Given that nearly all e-commerce sales for electric bicycles tracked by Workstand are “click and collect,” bike shops can benefit from this trend by capturing a portion of online sales and generating foot traffic in brick-and-mortar storefronts. Click and collect allows both the convenience of shopping online and the peace of mind knowing there is a local dealer available for support.

Customers are not only comfortable buying e-bikes online, but also used. According to Bicycle Market Research, e-bikes have the lowest stock-to-sales ratio of any bicycle category, indicating strong demand.*** Further, the growth in used e-bike unit sales is outpacing used sales of traditional bikes.

Have a question for the Nerd Collective to answer in a future blog? Submit it here.

*Based on Circana/Retail Tracking Services, US Cycling POS Monthly

**Based on Workstand IBD e-commerce sales data

***Based on Bicycle Market Research data on peer-to-peer used marketplaces (eBay, Craigslist, Facebook Marketplace, Mercari)